Corporate client services

If your business is exposed to fluctuations in foreign exchange markets, IFX Payments will work with you to optimise your position, minimise your risk, and manage your costs.

Contact usCorporate clients

Our service

Market information

We will act as your eyes and ears in the markets, monitoring currencies and keeping you advised about upcoming economic events or trends that may impact the exchange rates that matter to your business.

Active hedging

Our unparalleled FX solutions enable you to work alongside your dedicated financial expert to manage your currency exposures, using a bespoke strategy that will protect your margins and deliver certainty.

Passive hedging

Leveraging years of expertise, we can also manage your foreign exchange exposure automatically with our API. This supports micro-hedging and multi-currency pricing (MCP) to help protect your margins.

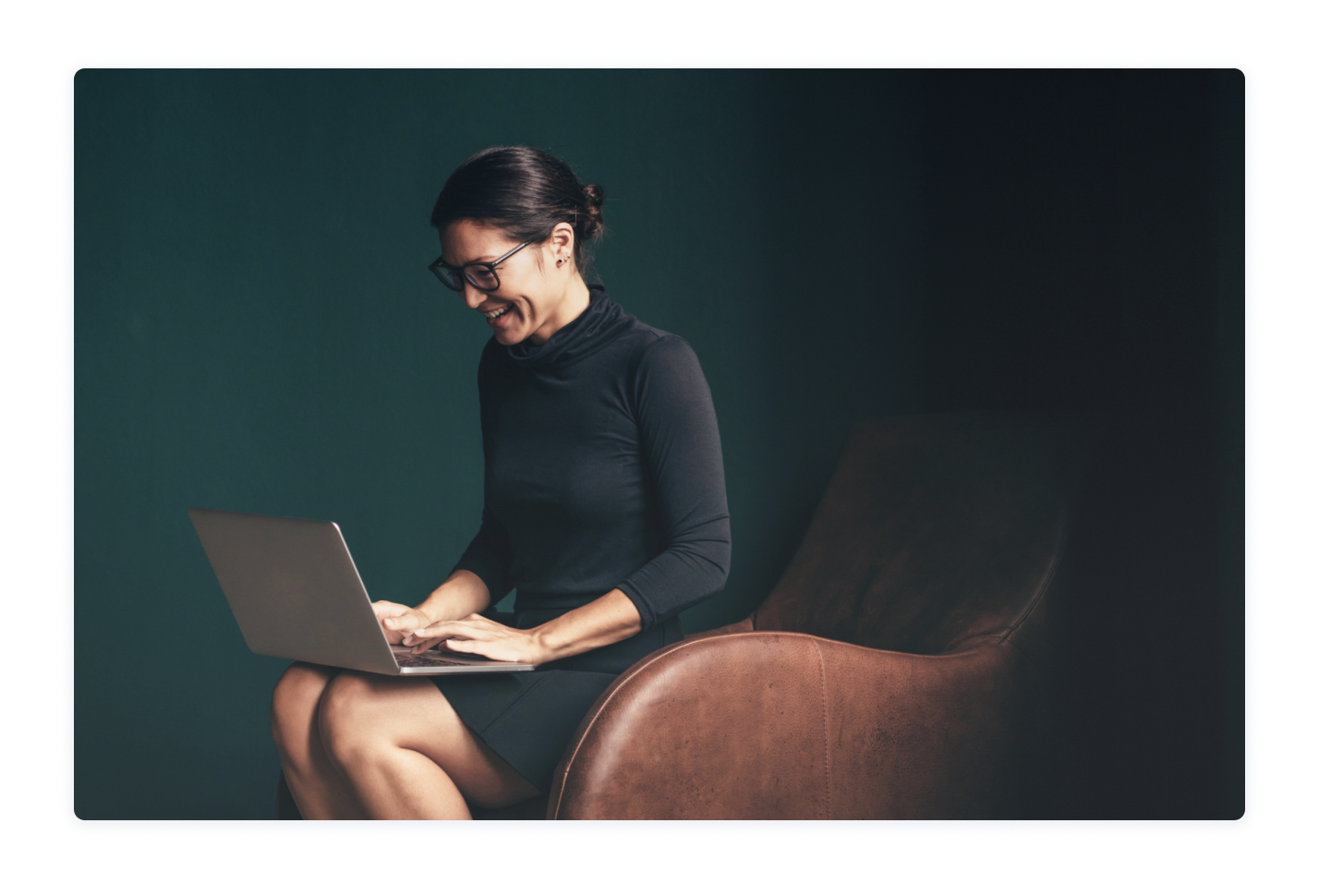

Our clients say

We have enjoyed a successful partnership with IFX for over 5 years now. We have been impressed since day one with their energy and enthusiasm to develop a market leading FX partnership for our sector.

Sales Director - UK based moving company

learn more