Payments Technology Redefined.

We’ve built our own FX and payments infrastructure to offer clients a quick, secure and easy to use service; all at low cost. Whether it’s a single transfer or your international payroll run, IFX Payments have global cross border payment solutions to save you time and money.

Contact usBespoke treasury management

We offer a range of tailored services to help businesses and individuals manage their foreign exchange and payment demands. We work with you to find a solution that works for you.

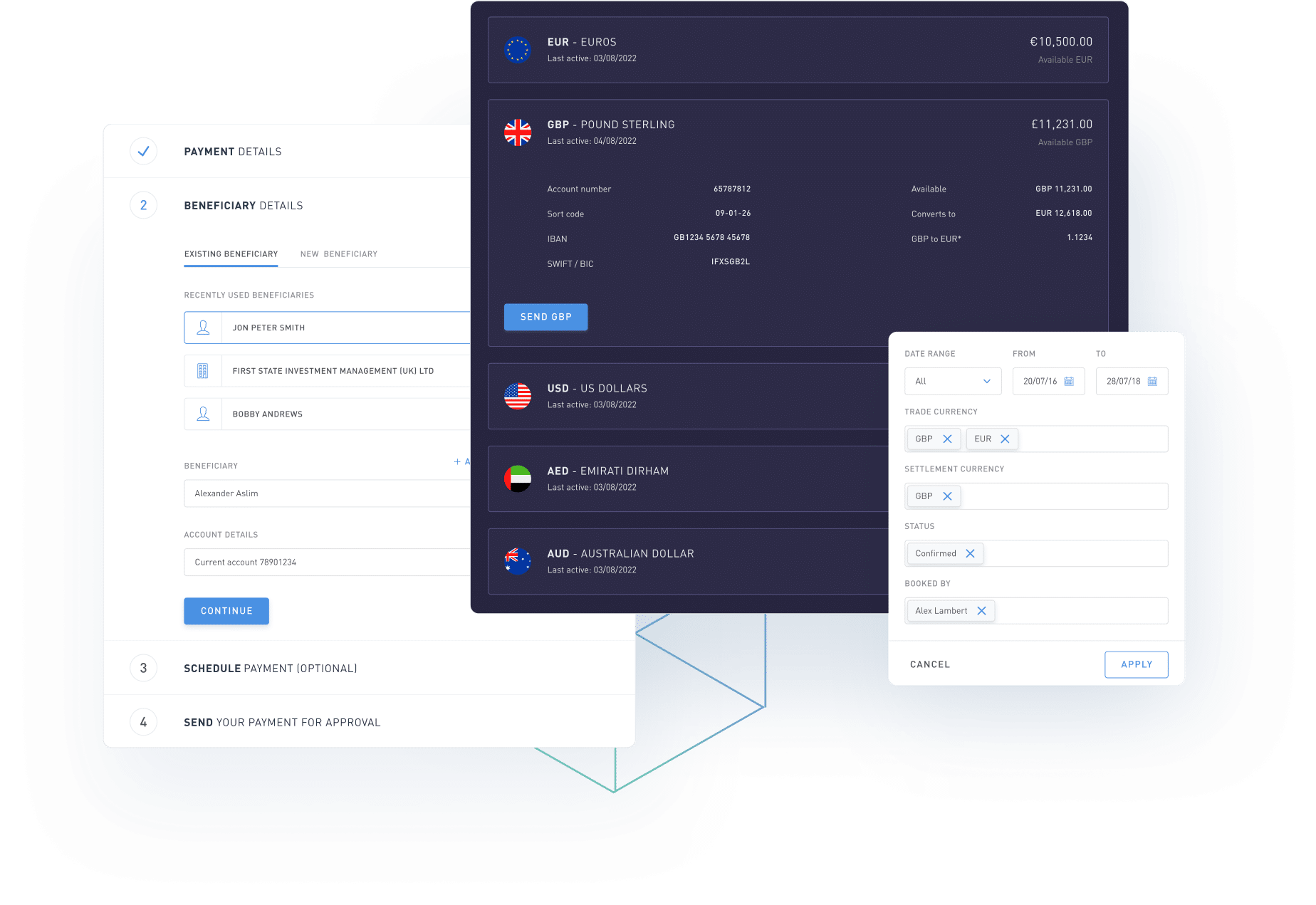

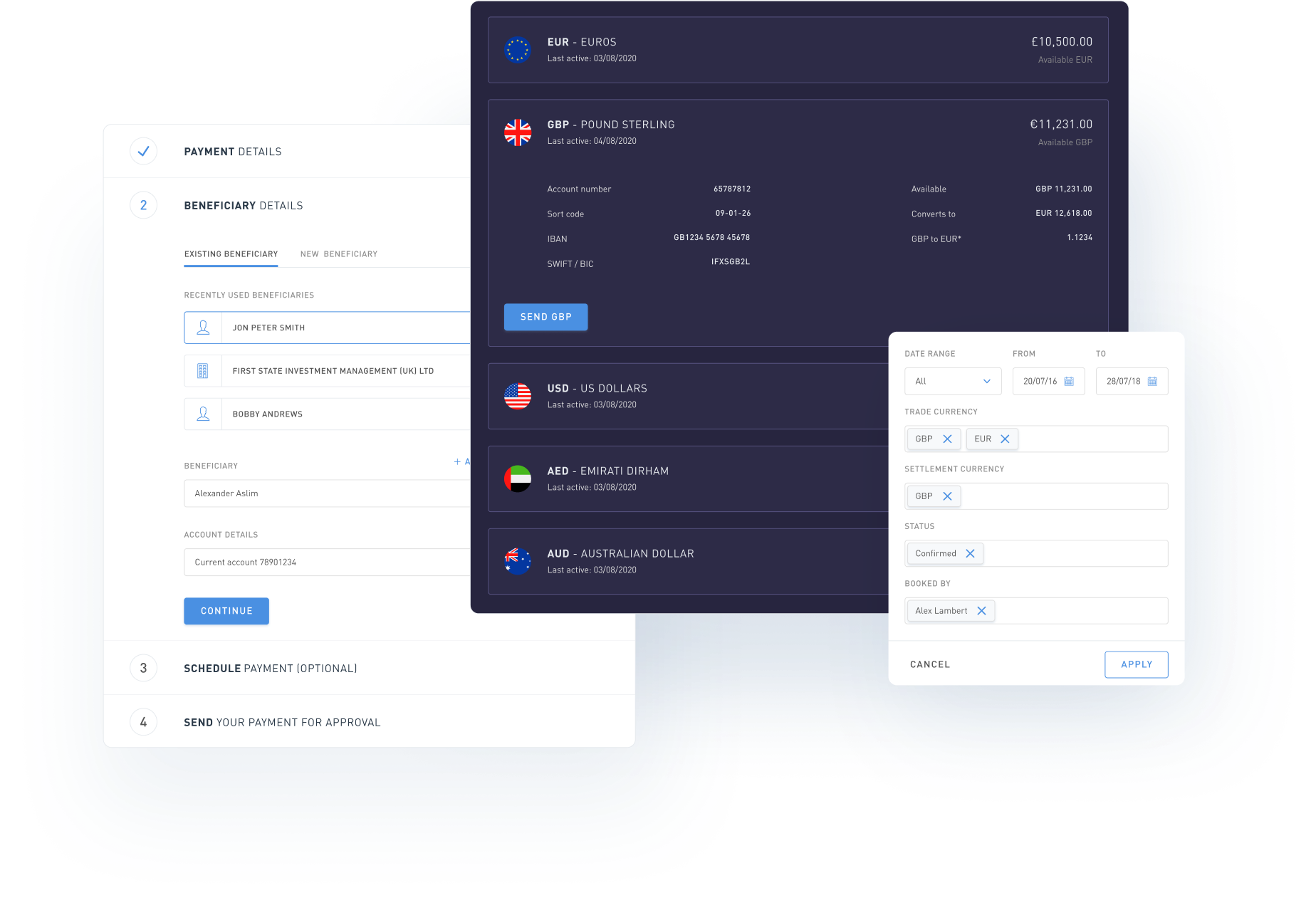

Digital wallet

A multi-currency, virtual IBAN account integrated directly into our foreign exchange services and global payments infrastructure. ibanq allows businesses to maintain, manage and distribute funds in over 38 currencies from one single account.

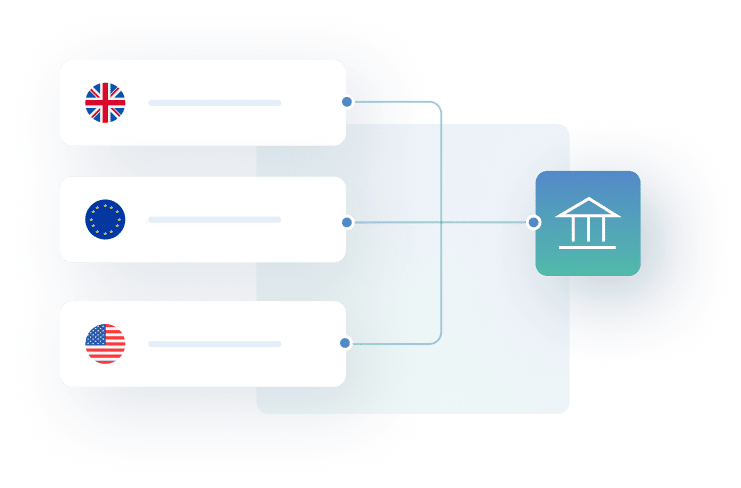

International payments

Benefit from faster settlement speeds and cheaper transaction costs by connecting into our seamless and extensive banking network for both domestic and international payments.

API ready

Remove time consuming and cumbersome manual intervention by connecting directly to our easily accessible and developer-friendly API for a more enhanced and bespoke solution.

Mass payments

A complete cross-border payment solution providing streamlined access to over 100 currencies in more than 120 countries. Pre-validate and send tens of thousands of payments in just a few clicks.

Partnerships

We work to support our ambitious partners by offering their clients a level of strategic support, personal service, and cost-saving that banks and other mainstream providers cannot match.

FX risk management

Seemingly small fluctuations in exchange rates can dramatically impact the amount that need to be paid so our expert currency consultants work with our clients to identify the best FX solutions.

Clients say

Brentford FC

"Having to navigate the complex industry that is professional football, our partners at IFX Payments have taken the care and time to learn about our specific business needs and provided effective solutions to help manage our currency exposure. Professional and diligent, we wouldn’t look any further than IFX and look forward to continuing our long and successful relationship."

Learn more